Lush farmland, big stately homes tucked away in the countryside, and rolling hillsides along the Mississippi River – what’s not to love about living in Iowa? The Hawkeye State is considered the safest state to live in America. It has about 30 million farm acres, which cover 90% of the state, although nearly 60% of Iowa farmland owners don’t actively farm, according to Iowa State University statistics.

The safety, the tranquility, the generous space—they’re all appealing draws for anyone setting their eyes on homeownership in the Hawkeye State. If you’re a first-time homebuyer in Iowa, there are plenty of statewide and local homeownership assistance programs on hand to help you with your big purchase.

Buying your first home is an exciting milestone that takes some work. These first-time homebuyer programs can help you with everything from securing a low interest home loan to saving for a down payment or taking advantage of tax credits.

Read on to learn more about these programs, their eligibility requirements and how to apply.

Who Qualifies as a First-Time Homebuyer in Iowa?

A first-time homebuyer in Iowa is any family or individual who has never owned a home. However, for quick clarification, you’re also considered a first-time homebuyer if you haven’t owned a home in the past three years, according to the majority of these state and regional homeownership programs.

If you’re nearing the three-year mark, it may be worth waiting so you can become eligible again for any of these homeownership programs. Taking advantage of these first-time homebuyer perks could save you a lot of money through securing a lower interest rate on your mortgage or a 0% interest loan to cover your down payment.

There’s a silver lining, too. The statewide programs listed below apply to first-time homebuyers, military personnel, repeat homebuyers who haven’t owned a home in the last three years or anyone buying a home in a targeted area.

As always, when you’re doing your research, read the fine print. Also refer to limitations listed below.

Statewide Homeownership Assistance Programs

The Iowa Finance Authority (IFA) has a series of statewide assistance programs that are worth exploring for first-time homebuyers and repeat homebuyers alike. The programs include low interest home loans, down payment assistance and help for military homebuyers.

While the programs differ, the overarching requirements include being a resident of Iowa, working with a participating lender, and purchasing eligible property types which must be used as a primary residence. These programs are available across in each county.

Here’s a look at program details. We’ve also included an Iowa Department of Revenue program, which offers a specialized savings account earmarked for first-time homebuyers.

IFA First Home Program

The First Home Program connects homebuyers to local lenders. With an IFC loan, homebuyers can gain access to 25- or 30-year fixed rate mortgages with interest rates that are typically lower than the market rate and have fewer fees. Your credit score won’t affect your interest rate like conventional mortgages may. Your loan may require only 3% down and may include lower mortgage insurance too.

To help with the upfront costs, the First Home Program offers homebuyers with either a down payment assistance grant of up to $2,500 or a second mortgage of up to 5% of your home’s sale price or $5,000 (whichever is less). The second loan is repayable only when you sell or refinance your home or when your mortgage is paid in full. No monthly payment is required.

Homebuyers can also request a free Iowa Title Guaranty Owner’s Certificate at closing. With this certificate, if there’s a title issue, the guaranty steps in and assumes attorneys’ fees, costs and expenses involved with defending the title to your home. This is a rarity in Iowa, but the IFC notes that it can happen. This certificate comes at no cost to you and is an extra layer of protection.

To qualify for the First Home Program, homebuyers must adhere to country household income and home purchase price limits.

You must either be a first-time homebuyer who hasn’t owned a home in at least three years, a military member who has not taken out an IFC mortgage, or a homebuyer purchasing a home in a targeted area.

Your home purchase must be used as your primary residence, you must have a credit score of at least 640, and a debt-to-income ratio of 45% at maximum. You’ll also need to complete a homebuyer’s education course too.

To see if you qualify, use IFC’s convenient Eligibility Checker, which factors in Targeted Areas, income limits and home purchase price limits. Also check out the IFC homebuyer education course options here.

Additionally, visit First Home Program’s site to apply and find a lender.

IFA Homes for Iowans

The Homes for Iowans program is nearly identical to its First Home counterpart. Homebuyers can take advantage of securing a low interest 25- or 30-year home loan, with a smaller down payment and cheaper home insurance. They can also apply for a $2,500 grant to help with the down payment or a second mortgage of up to 5% of your home’s sale price.

The requirements are identical too – from household income, home purchase price limits, credit score, and debt-to-income ratio.

The difference? Homes for Iowans removes any requirements for real estate history – the program is fair game to anyone who is purchasing a home to use as their primary residence.

Read more about Homes for Iowans.

IFA Military Homeownership Assistance Program

Are you a military serviceman or veteran? The IFC’s Military Homeownership program was created to thank Iowa’s service members for their dedication to the country.

The program awards homebuyers who qualify a $5,000 grant to help with down payment and closing costs. You can pair this program with the First Home or Homes for Iowans programs to secure a low interest loan.

To qualify, you must be an active military person, veteran or a surviving spouse of an eligible service person who has had an honorable discharge. Homebuyers must receive prior loan approval before closing on a qualified home. They’ll need to work with an IFA participating lender.

Eligible homes must be within Iowa state limits and must be used as the primary residence. Single-family residences are allowed. This includes manufactured homes as long as they’re attached to a permanent foundation.

Check out the Military Homeownership Assistance Program for more details.

IFA Mortgage Credit Certificate Program

The MCC, offered by the Iowa Finance Authority, provides eligible first-time homebuyers a non-refundable federal income tax credit used with your first mortgage. In a nutshell, it reduces your federal income taxes, creating additional income for you.

The tax credit amount can be up to 50% of your annual mortgage interest paid and is available annually as long as the home remains as your primary residence. Homeowners with the MCC are allowed to use a percentage of their actual mortgage interest as a direct dollar-for-dollar federal tax credit. The official website notes there may be a $2,000 cap.

Read more about the Mortgage Credit Certificate here.

First-Time Homebuyer Savings Account

The Iowa Department of Revenue established a First-Time Homebuyers Savings Account – or FTHSA, which is a special type of bank account to help Iowans save for their home. Account holders can contribute up to $2,000 (or $4,000 joint) tax-free each year to a dedicated down payment savings account. You can save up to a lifetime maximum of $20,000 tax-free. Accounts can even be created for any beneficiary.

The cash in your savings account can only be used for expenses related to buying your first home, specifically for your down payment and closing costs.

To qualify, you must be a first-time homebuyer or a buyer who hasn’t owned a home in at least three years. Your contributions must remain in your account for at least 90 days before use and your contributions can’t remain in your account for longer than a decade.

Most banks across Iowa offer this savings account. Check with your bank to start the process.

Read more about the FTHSA on its Iowa Department of Revenue program page.

Individual Development Accounts (IDA)

In 2009, the Iowa Department of Human Rights organized an Individual Development Accounts to help low-income working Iowans save for higher education, job training, buying a home, or purchasing assistance technology for a family member with a disability.

Eligible Iowans can qualify for up to $2,000 in state matched funds for their savings.

Read more about the Individual Development Account on its official website.

Homebuyer Programs by Location in Iowa

While the statewide programs listed above can give you a financial boost, there are plenty local homebuyer assistance programs across Iowa that are generous with financial aid.

The programs are a mixed bag – some are exclusively for first-time homebuyers or anyone who hasn’t owned a home in the past three years, while others shift the focus to those in a lower-income bracket. Read more for our full rundown of local programs.

Cedar Rapids

Are you house hunting in Cedar Rapids? Pleasantly nicknamed the City of Five Seasons, Cedar Rapids offers its own First-Time Homebuyer Program, which provides between $1,000 and $15,000 in down payment and closing cost assistance to eligible homebuyers. The assistance is forgiven after five years of homeownership, so it doesn’t need to be repaid.

To be eligible, there are four main criteria: you must be a first-time homebuyer, and you must meet income requirements, home eligibility requirements, and debt and mortgage criteria. As always, you’ll need to complete a homebuyer’s education course.

Visit the program’s official Cedar Rapids page for more information.

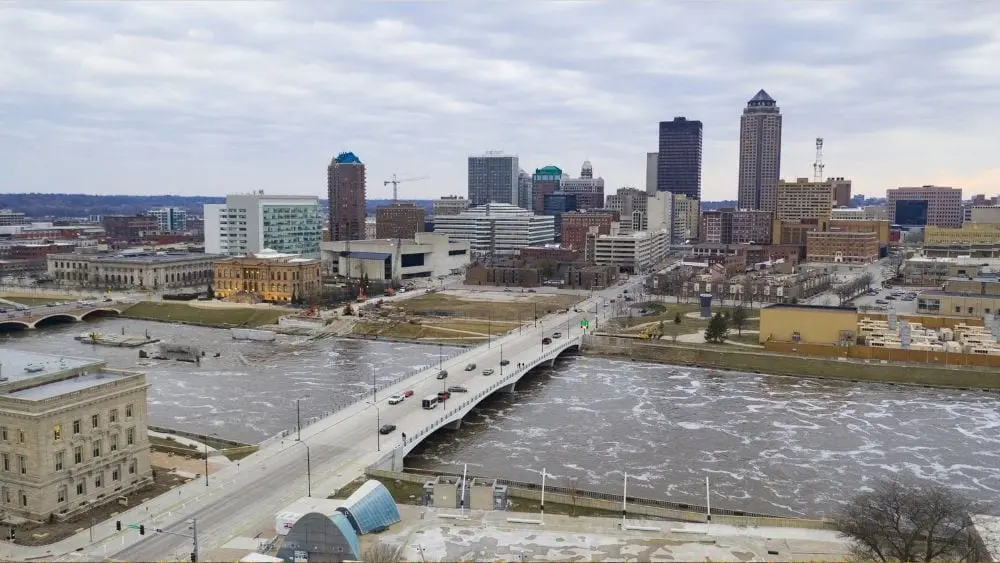

Des Moines

Are you shopping for a new home in Des Moines? Iowa’s capital city has the largest real estate market in the state with over 20 new home communities. Des Moines also pours its funding for homeownership assistance into a handful of the city’s non-profit partners.

Home Inc., for example, runs a string of programs to help current homeowners pay for much needed repairs and renovations. Rebuilding Together is aimed at helping rehabilitate homes of veterans, seniors, people with disabilities and families with dependent children, while Rock the Block helps low-income homeowners with renovations for weatherization, safety, accessibility or beautification.

The Neighborhood Finance Corporation offers a Purchase Program, providing homebuyers with a forgivable loan of up to $10,000, which must be used to help to purchase your home or make renovations. You can also apply for a first mortgage loan of up to $300,000 and a second mortgage loan worth up to 15% of your home’s purchase price at 2% interest for 10 years. Down payment and closing costs assistance are available in most lending areas.

To qualify, the emphasis is on buying in an NFC lending area in Des Moines (or Cedar Rapids).

Read more about the Des Moines programs on the city’s official website.

Dubuque

House hunters in Dubuque should zero in on the city’s True North Homebuyer Program. It provides long-term, 0% interest loans of up to 20% of their home’s purchase price to help locals with their down payment. The maximum loan amount is $25,000 and you won’t have to repay a penny until you sell or refinance your home.

To qualify, you must meet income requirements, complete a homebuyer’s education course, and you contribute at least 3% of your home’s price in your purchase; you are responsible for contributing 1% but 2% can be gifted money.

You can read all about the True North Homebuyer Program on the City of Dubuque’s website. The details income the income guidelines you’ll need to follow, the full requirements and contact details for next steps.

Rural Iowa

Whether you’re in Bremer, Calhoun, Greene, Hamilton, or Humboldt, Homeward Inc. has a Down Payment Assistance Program that provides up to $7,000 as a half grant and half loan. The $3,500 loan is repaid over the course of 5 years at 4% or over the course of a decade at 5%.

Homeward Inc. was created in 1996 by a group of Iowa’s rural electric cooperatives to help the state’s rural communities. The organization has provided over $6.9 million in down payment and home improvement loans to nearly 2,000 rural families since its inception.

Homeward Inc.’s programs are aimed at helping its 25-county area reach. To be eligible, your home must be in one of these counties and in a community of less than 20,000 residents.

Read more about the Homeward Inc. Down Payment Assistance Program on its website, or via its official brochure. You can complete an application here.

Waterloo

If your heart is set on buying a home in Waterloo-Cedar Falls, the Waterloo Housing Authority operates a Down Payment Assistance Program that provides eligible applicants with a forgivable second mortgage. The amount varies per homebuyer.

The focus is on helping low-income households obtain a home. Homebuyers cannot exceed 80% of the median income for their area. They must be a current resident of Waterloo for at least one year, complete a homebuyer’s education course, and they must not have owned a home for the last three years. Check out details of the WHA Down Payment Assistance Program.

The City’s Community Development Center also operates its own Waterloo Down Payment Assistance Program. In this case, first-time homebuyers can apply for up to $5,000 in funding, provided as a five-year forgivable loan. As long as you manage your mortgage and use your home as your primary residence for 5 years, you won’t have to repay the loan.

The City also has a New Construction Down Payment Assistance Program, which provides homebuyers with a forgivable loan that could range from 25% up to 30% of their home’s sales price. The catch? You’ll need to buy a new construction home in a targeted area, you must be income eligible and you need to work with a participating lender.

Read more about the New Construction Down Payment Assistance Program.

Wright County

Home buyers in Wright County will want to look into the Home Purchase Assistance Program. The program offers a second mortgage loan of up to 10% of your home’s purchase price, to a maximum of $8,000. The cash can be used for your down payment, closing costs, or home repairs required by your lender.

The loan must be repaid in 5 years with an interest rate that matches your home loan.

To be eligible, you’ll need to submit a budget that demonstrates that you can manage second loan repayments, use the home as your primary residence and purchase a home within Wright County limits.

There are no income guidelines and no restrictions on repeat homebuyers.

Check out the Home Purchase Assistance Program.

Ready to Buy a Home in Iowa?

Whether you’re shopping for a home in Iowa City or you’re thinking of settling in at Cedar Rapids, there is no shortage of housing options in the Sunshine State. The real estate market in Iowa is varied from lovely college towns along the Iowa River, quiet counties along the Mississippi River to busier city life in Des Moines.

And wherever you decide to hunker down, there are multiple programs to help you secure your home purchase.

Check out more listings across the state of Iowa and follow us on social media for more home shopping tips and tricks!

The links on this site were researched by NewHomeSource. This is as cohesive a list as possible. Individual homebuyers should contact entities to fully understand requirements and processes.

Other Iowa Resources

Carmen Chai is an award-winning Canadian journalist who has lived and reported from major cities such as Vancouver, Toronto, London and Paris. For NewHomeSource, Carmen covers a variety of topics, including insurance, mortgages, and more.

Flooring Options That Are Literally Pet and Kid Proof

Flooring Options That Are Literally Pet and Kid Proof