Oftentimes, would-be homebuyers stop before they even get started, thinking that owning a home is financially out of reach. Some go so far as to run a few calculations, but once they see the amount of cash needed for the down payment and closing costs, discouragement sets in.

If you reside in the Lone Star State, this is not the end of the story; the good news is there are statewide financial programs to help Texans become first-time homebuyers!

What Qualifies as a First-Time Homebuyer in Texas?

A quick clarification about what it means to be a first-time homebuyer is in order because it’s not as obvious as it sounds. In the state of Texas, a first-time homebuyer is defined as any family or individual who hasn’t owned a home within the last three years. So even if you previously owned a home – but have not owned one in the last three years – you are classified as a first-time buyer.

Additionally, the first-time homebuyer requirement is often waived for honorably discharged veterans. This unlocks doors – front doors – for many more individuals to take advantage of these programs!

Statewide First-Time Buyer Programs

Take a look at the following programs available statewide to Texas residents.

My First Texas Home Program

This program is for first-time homebuyers (see the above definition) and veterans. Depending on what you’re looking for, the My First Texas Home program can assist with down payment, closing cost, and home loan expenses.

This statewide program requires homebuyers to work with a pre-approved list of participating lenders. Note: there are additional eligibility requirements, such as income limits and purchase maximums. Application approval gives you access to a range of benefits, including a 30-year fixed rate mortgage loan.

Texas Mortgage Credit Certificate Program

Like MFTH, this program is open to first-time homebuyers as defined by the state, as well as veterans. While income and purchase requirements must be met, there is no minimum credit score like there is with MFTH.

The program offers a “dollar-for-dollar reduction on federal tax liability.” Translation: homebuyers are allowed to claim a tax credit on the mortgage interest. This incentive, especially when paired with MFTH, can result in significant financial benefits for homebuyers.

Statewide Non First-Time Buyer Programs

While the above programs are strictly available for first-time homebuyers, there are other Texas programs to assist individuals looking to move from one home they have owned into another.

Homes for Texas Heroes

Eligibility is first designated by profession, which includes public school teachers, counselors, nurses, and librarians. This list expands to include fire fighters, police officers, EMS personnel, veterans and active military.

By working with a list of pre-approved lenders, eligible buyers gain access to several mortgage rates and loan options and down payment assistance. Visit the Texas State Affordable Housing Corporation for more details.

Home Sweet Texas Home Loan Program

For home buyers with low to moderate incomes who need additional assistance, the Home Sweet Texas Home Loan Program is available. This option can grant the same benefits as the other programs listed here — competitive mortgage rates and loan options, as well as down payment assistance — but is available to a wider pool of applicants.

Check out the HSTH page for more information.

Southeast Texas Housing Finance Corporation’s Programs

Southeast Texas Housing Finance (SETH) offers three programs covering large regions of the state: The HomeStar program, the 5 Star Texas Advantage Program, and the Homeownership Across Texas program. The first program is truly statewide, while the other two are available in all but a handful of locations, which are the city limits of El Paso, Grand Prairie, McKinney, and Travis County.

Homebuyer Programs by Location

In addition to the above statewide programs, there are homebuyer assistance programs based in different cities and regions of the state. Many are open to both first-time homebuyers and repeat buyers. See each individual program for more details.

Abilene

If your heart is set on buying in Abilene, the city’s First Time Home Buyers Program is there to help with down payments and closing costs. Applicants must have lived or worked in Abilene for a minimum of six months. Learn more at their Office of Neighborhood Services site.

Arlington

For low income first-time buyers, the Arlington Homebuyers Assistance Program offers assistance up to $20,000 toward home purchase. Income maximums apply, and there is a minimum residency period following the purchase. They’ve got more details on their website.

Austin

Want to find a new home in the state capital? Austin offers a first-time homebuyer’s Down Payment Assistance Program. Learn which lenders are approved and what’s involved in the application process at the department’s site.

Baytown

For those wanting to settle down in Baytown, the city offers a First-Time Homebuyers Assistance Program that will grant up to five percent of the sales price in funds. For more information and to apply, head over to Baytown’s Planning & Development website.

Beaumont

First-time homebuyers who want to purchase a home in Beaumont should apply for the Down Payment Assistant Program. Up to $15,000 can be awarded to help pay for expenses; visit Beaumont’s website for more information.

Brazoria County

This county in the Gulf Coast area includes all or parts of nearly 30 different cities and towns. Angleton is the county seat, and other well-known cities are Pearland and Freeport. The county website provides more information on assistance for first-time homebuyers.

Bryan

Just outside College Station (the home of Texas A&M University), the city of Bryan offers a Homebuyer Assistance program that awards a minimum of $3,500 toward home purchasing. Income limits apply, and buyers must occupy the home for a minimum of five years. Learn more on Bryan’s official website.

Corpus Christi

If you want to buy a new home in Corpus Christi, you’ll be glad to know that the city offers two programs for your consideration. The Down Payment Assistance Program, which grants up to $10,000; and the Homebuyer Closing Cost Assistance Program, which offers the same amount. Both programs have income limits and require a minimum five-year residency following purchase.

Dallas

Depending on income and family size, those looking to buy a new home in Dallas can apply for financial assistance. Areas that the city has designated as ‘high opportunity’ may have access to more funds than those in ‘non-high opportunity’ areas. Visit the city website for more information.

Denton

The city of Denton offers a Home Buyer Assistance program to shoppers with low-to-moderate incomes. Nearly $15,000 can be granted toward a primary residence; applicants must meet several eligibility requirements, including home size and family income. Learn more about the program here.

Fort Worth

If you’re looking at new homes in Fort Worth, be sure to get familiar with their Homebuyer Assistance Program. Eligible buyers can receive up to $20,000 in mortgage assistance. First-time homebuyers can visit their website for more details.

Frisco

This occupation-based program is great for homebuyers shopping for a home in Frisco. Low and moderate income families employed by the City of Frisco or the Frisco Independent School District can apply for a down payment assistance of up to $10,000 when purchasing a home. Learn about other requirements and get an application from the city’s website.

Galveston

Buy your new home in historic Galveston with the help of the city’s Homebuyer Assistance Program, which grants money toward down payment and closing costs. Requirements include completion of a homebuyer education course. See the full list of requirements and apply at Galveston’s Grants & Housing Department website.

Harris County

Income eligible first-time homebuyers looking to settle down in Harris County can apply for Down Payment Assistance of up to $23,800. View the Harris County website for more details on eligibility requirements.

Houston

Texas’ largest city offers up to $30,000 to income-qualified first-time homebuyers seeking home ownership. Find your dream home in Houston with one of their two programs: The Homebuyer Assistance Program or the Harvey Homebuyer Assistance Program, which is specifically for Houstonians living in the city during Hurricane Harvey. The city’s Housing and Community Development website has more details.

Killeen

First-time homebuyers looking to settle down in Killeen can apply for the Homebuyer Assistance Program and receive up to $7,500 toward down payment and closing costs. Additional requirements include attending homebuyer education classes. Visit the city’s HAP website for details.

Laredo

The city of Laredo offers first-time homebuyers Down Payment Assistance of up to $30,000 for home purchasing. Eligibility is also determined by income, and approval comes with a required 10-year consecutive residency in the home after purchase to avoid repayment. Learn more on Laredo’s website.

McKinney

This first-time homebuyer’s program offers down payment and closing cost assistance to low and moderate income buyers looking at homes in McKinney. Area median income restrictions apply. Obtain more information here.

Mesquite

If new homes in Mesquite have caught your eye and you’re a first-time homebuyer, you’ll want to check out the city’s Down Payment Assistance Program. Moderate and low income families can apply for a zero percent interest forgivable loan toward expenses. Learn more about eligibility at the city’s housing site.

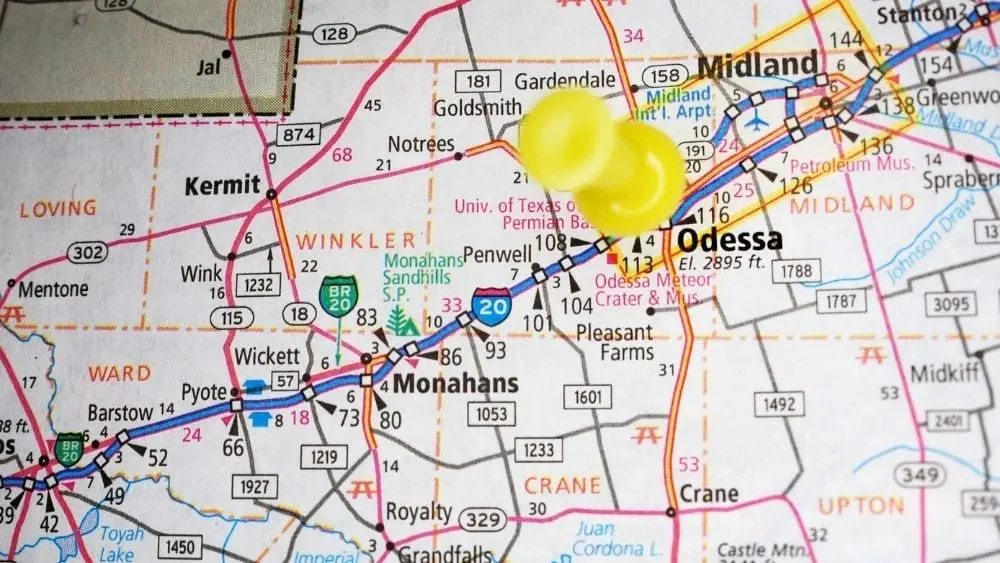

Midland

Through the city’s Community Development Office, first-time buyers looking to purchase a new home in Midland can apply for up to $15,000 in financial assistance toward home purchasing. Visit their website for more details.

Odessa

Open to first-time and repeat homebuyers, the city of Odessa offers up to $24,000 toward the purchase of new build homes. Family income and size determines the specific amounts. Visit their city website for information.

Plano

To assist purchasing homes in Plano, the city offers down payment and closing costs assistance in the form of deferred payment loans. First-time homebuyers with qualifying low or moderate household incomes can click here to learn more details and apply for the City of Plano’s First Time Homebuyers Assistance and Educational Program.

San Angelo

The city of San Angelo offers two options for homebuyers. The Homebuyers Assistance Program is available for first-time homebuyers with low-to-moderate incomes. Buyers must live in the home for a minimum of five years to avoid repayment.

The Affordable Housing Assistance Program is a gap reduction or mortgage buydown option. Approved buyers must live in the home for at least 30 years or risk partial or full repayment. You can find more information on both programs here.

San Antonio

Home to the Alamo, San Antonio offers multiple down payment assistance programs to help homebuyers. The Homeowner Incentive Program (HIP 80) awards up to $15,000 toward down payment expenses and additional costs. A five-year residency is required to avoid repayment.

When funds are available, the city also has a First Responders Homebuyer Assistance Program (FRHAP), which grants a minimum of $7,500 to uniform police and fire employees employed by the city. Finally, the city has a Homeownership Program for Employees (HOPE) which provides a minimum of $5,000 to full-time civilian employee homebuyers.

San Marcos

South of San Antonio sits San Marcos, home to Texas State University. If you’re looking to purchase a new San Marcos home, the Community Development Block Grant Homebuyer Assistance program can provide you with up to $7,000 toward housing costs.

Additionally, the city offers incentive programs for those employed by San Marcos Consolidated Independent School District, Texas State University, and the city. Learn more about both programs on the city’s housing website.

Texas City

If you’re looking to buy a home in Texas City, be sure to explore their First-Time Homebuyer’s Program for income-eligible home shoppers. Visit the Texas City website for information.

Texarkana

The Homebuyer Assistance Program offered by the city is available for any home within Texarkana city limits. The money can go toward down payment and closing costs. Check out their website for more details.

Travis County

If you want to cast a slightly wider net than just Austin, the entirety of Travis County offers a program to help. The Hill County Home Down Payment Assistance Program is an income-based program to help potential homebuyers secure an FHA, VA, USDA-RD, or Freddie Mac HFA Advantage loan. Visit Travis County’s website for more details.

Tyler

For money needed up front at closing, the City of Tyler offers a Homebuyer Assistance Program to help cover down payment and closing costs. This program is for first-time homebuyers and includes additional income and residency term requirements in order to be approved. Visit Tyler’s Neighborhood Services Department for more information.

Victoria

Southwest of Houston, the city of Victoria offers first-time homebuyers a Mortgage Assistance Program, which grants up to $2,500 toward down payment and closing costs. Learn more on the city’s official website.

Wichita Falls

First-time homebuyers wanting to purchase a home in Wichita Falls should look into the city’s First Time Homebuyer Program, which awards up to $7,500 toward closing costs, down payments, or reducing the mortgage loan principal. Learn about eligibility requirements on the city’s Neighborhood Resources page.

Waco

If you’re looking to settle down in Waco, the city’s down payment and closing cost assistance can help bring that plan to fruition. Approved applicants can receive up to $25,000 in a no-interest loan; additional eligibility requirements apply. Visit the City of Waco’s official website for more details.

Help Buying a New Home in Texas

Has that new home in the Houston, Texas area been calling your name? Or perhaps you’d prefer the slightly cooler temperatures in the panhandle, near Amarillo? No matter where you’re looking in the Lone Star State, there are plenty of new homes available; even better, there are several programs to help make your dream home a reality.

Check out more listings across the state of Texas, and follow us on social media for more tips on the home buying process!

The links on this site were researched by NewHomeSource. This is as cohesive a list as possible. Individual homebuyers should contact entities to fully understand requirements and processes.

Other Texas Resources

Kian Zozobrado joined Builders Digital Experience (BDX) in 2019 as a content writer. A graduate of Southwestern University with a degree in English, Kian is passionate about the written word and making connections. Outside of work, Kian also serves as president of the Board of Directors for the Writers’ League of Texas.

Best Suburbs Near Las Vegas

Best Suburbs Near Las Vegas