With the expanse of beaches, nature reserves, the buzz of city life and the ease of wine country, it’s no wonder that thousands of new homebuyers flock to California every year. This state hosts an adventure that appeals to any interests, whether you prefer to live in a flourishing urban setting or a calm country town.

If you are planning to put down roots in California, you are likely aware of the potentially heavy budget impact. No matter where you are in the process of choosing your dream home, it can be overwhelming to see the total purchase cost and identify your financial options.

Fortunately, because California has a booming housing market, there are several state and local programs to help first-time homebuyers lighten the load.

Who Qualifies as a First-Time Homebuyer in California?

Requirements for eligibility as a first-time homebuyer often vary by state, so it’s important to define this term. In California, an individual is considered a first-time homebuyer if they have not owned and occupied a home within the previous three years.

If you have never owned a home or if you sold your home more than three years ago without purchasing a home since the sale, you may be eligible for California Housing Finance Agency’s first-time homebuyer programs.

California First-Time Buyer Programs

Here are a list of homebuyer assistance programs available to California residents.

MyHome Assistance Program

Operated by CalHFA, the MyHome Assistance Program is a deferred payment, simple interest rate subordinate loan that may only be available to first-time homebuyers purchasing owner-occupied property in the state of California. This loan may be used for down payment assistance and/or closing costs.

This is especially appealing to most low-to-moderate income homebuyers, as it also allows the borrower to layer other assistance loans or grants to maximize savings. Borrowers may be subject to additional income limits and credit requirements. School employees and fire department employees may be exempt from some restrictions.

CalHFA USDA Program

The CalHFA USDA Program is a USDA Guaranteed first mortgage loan program for first-time homebuyers. This USDA income limits for this loan may be more restrictive than CalHFA’s income limits and this loan also carries its own rural area restriction overlays. It can also be combined with the MyHome Assistance Program (MyHome).

CalHFA Conventional Loan Program

The CalHFA Conventional program features a first mortgage loan insured through private mortgage insurance on the conventional market. Interest rates on CalHFA Conventional loans are fixed throughout the 30-year term. Borrowers may be subject to income limits, credit restrictions and other restrictions. First-time buyers must complete a homebuyer education course to be considered eligible.

CalPLUS Conventional Loan Program

Similar to the program above, the CalPLUS Conventional program is a conventional first mortgage, but with a slightly higher 30 year fixed interest rate. The CalPLUS Conventional Loan may also be combined with the CalHFA Zero Interest Program (described in more detail below) for closing costs.

CalHFA FHA Program

The CalHFA FHA Program offers an FHA-insured loan with a CalHFA 30 year fixed interest rate for your first mortgage. Loans are subject to credit and income requirements. The borrower must complete a homebuyer education counseling course and reside primarily in the residence.

CalPLUS FHA Program

The CalPLUS FHA program is similar to the above CalFHA program, but features a slightly higher 30 year fixed interest rate and is combined with the CalHFA Zero Interest Program (described in more detail below) for closing costs.

CalHFA Zero Interest Programs (ZIP)

As an added bonus to the CalPLUS programs and the MyHome Assistance Program, first-time homebuyers may take advantage of the CalHFA Zero Interest Programs (ZIP) to assist with closing costs. ZIP Programs feature a deferred payment, zero interest second mortgage that is only available in combination with the CalPLUS first mortgage program. Additional restrictions and limits may apply.

Statewide Non First-Time Buyer Programs

While the above programs are strictly available for first-time homebuyers, there are other statewide programs to assist individuals looking to move from one home they have owned into another.

GSFA Platinum Down Payment Assistance Program

The Golden State Finance Authority (GSFA) Platinum Program assists low-to-moderate income homebuyers in California by providing down payment and/or closing cost assistance. This program is not limited to first-time homebuyers, but borrowers may be limited by income restrictions and credit requirements. First responders and educators may be eligible to receive their assistance in the form of a grant (DPA Gift) rather than a second mortgage. DPA Gifts do not normally need to be repaid.

Cal-Vet Home Loans

California Department of Veterans Affairs (CalVet) home loans are available specifically for veterans in need. These loans can provide financial assistance as a component of several benefits and services for members. Verification may be required and restrictions may apply. See website for more information.

Local Homebuyer Programs by Location

In addition to the above statewide programs, there are homebuyer assistance programs based in different cities and regions of the state. Many are open to both first-time homebuyers and repeat buyers. See each individual program for more details.

Brentwood

The City of Brentwood offers a Down Payment Assistance Program (DAP) to first time homebuyers purchasing a “market rate” home in the city with additional assistance up $50,000 in order to provide a larger down payment contribution. More information and availability date is forthcoming, so you can continue to check the Brentwood City Hall website for details and contact information.

Emeryville

The First Time Home-buyer (FTHB) Loan Program offers down payment assistance to households of moderate to low income that are purchasing a market-rate or co-op home in Emeryville. This assistance is provided in the form of a low-interest, deferred-payment loan.

Chula Vista

The City of Chula Vista First-Time Homebuyer Program offers gap financing on first mortgages to allow first-time low-income buyers to purchase eligible properties more easily. This is usually a deferred loan with no interest that carries shared equity for the first 15 years, and is available to first-time buyers living in Chula Vista. Income limits and credit requirements may apply.

Clovis

The City of Clovis has a First-Time Homebuyer Program for low- to moderate-income households. This program provides low-interest, deferred loans to homebuyers to assist in decreasing monthly mortgage payments to an affordable amount for lower income households. Down payment assistance is available only to Clovis residents and eligibility may be subject to income level, credit approval and other requirements.

Corcoran

In cooperation with the nonprofit organization Self-Help Enterprises, the City of Corcoran offers programs featuring down payment assistance and additional financing options for first-time homebuyers. Corcoran’s Homebuyer Assistance Program has specific criteria for eligibility, such as income limits and credit restrictions, so be sure to review updated requirements on the city’s website.

El Cajon

The City of El Cajon offers two different programs to help first-time home buyers with down payment assistance. The American Dream and California Dream First-Time Homebuyer Programs may utilize a combination of HOME and/or Low and Moderate Income Housing Assets Fund (LMIHAF) for financial assistance to borrowers. The City does require a pre-qualification process and restrictions apply.

El Centro

If you are considering a home purchase in the southeastern region of the state, be sure to look into buying opportunities in El Centro. The El Centro First Time Homebuyer Program (FTHB) offers down payment assistance to all qualified first time homebuyers who are residents of the City.

Escondido

The City of Escondido’s Homebuyer Entry Loan Program (HELP) assists first-time homebuyers in Escondido. Eligible homebuyers may qualify for a low-interest loan of up to 5% of the purchase price that can be used for down payment assistance and/or for closing costs. Income and credit restrictions apply.

Fresno

The Fresno Homebuyer Assistance Program (HAP) helps low to moderate-income families or individuals located in Fresno County to purchase their first home by offering a zero interest, deferred payment loan that is not to exceed twenty percent (20%) of the purchase price. See website for restrictions and details.

Oakland

The First Time Homebuyer Mortgage Assistance Program (MAP) is a City of Oakland loan program, operating jointly with participating lenders, to provide assistance to low and moderate income first-time homebuyers purchase a home in Oakland. MAP loans offer assistance that fills the financial gap between the buyer’s available funds and the purchase price. You’ll have to double-check to confirm if this applies to Oakland-area suburbs.

Los Angeles

Southern California Home Financing Authority (SCHFA) is a joint powers authority between Los Angeles and Orange Counties, which provides first-time homebuyer programs for low- to moderate-income households. These programs include but are not limited to competitive 30-year fixed rate loans, closing cost assistance, and down payment assistance. See website for individual programs and eligibility criteria.

Monterey

The city of Monterey helps first-time buyers with a down payment assistance program for low to moderate income individuals and families. Check out Monterey Home Ownership Programs online for current offerings and to apply.

Paradise

The Town of Paradise offers financial support to first-time homebuyers through a deferred, low-interest loan to qualified borrowers based on established income limits as down payment assistance. The Paradise First Time Home Buyer Program is considered a bridge loan and will be based on the difference between what the borrower can afford to pay and the amount of money required to purchase the home. The loan does not require monthly payments and is due in 30 years. More information regarding restrictions and eligibility requirements are available on the website.

Porterville

The City of Porterville First Time Home Buyers Loan Program offers up to 35% of purchase price in low interest loans to applicants for down payment and closing cost assistance for qualifying first-time buyers in Porterville. Income and credit restrictions, and other eligibility criteria, may still apply. See website for more information.

Redding

In the City of Redding, home purchase programs such as the Redding Homebuyer Program Loan are available for first-time buyers or those who have qualified as a displaced homemaker or single parent. This assistance is offered to the eligible borrower as a second loan from the City of Redding and basic eligibility requirements do apply. Visit the City’s website to discover more information and to apply.

Riverside

First-time homeowners may take advantage of Riverside’s Mortgage Credit Certificate (MCC) Program, which entitles qualified homebuyers to lower the amount of their federal income tax liability by an amount equal to a portion of the interest paid during the year on a home mortgage. By increasing the effective income of the homebuyer, this tax credit may increase access to loans for the borrower and make their dream Riverside home a reality.

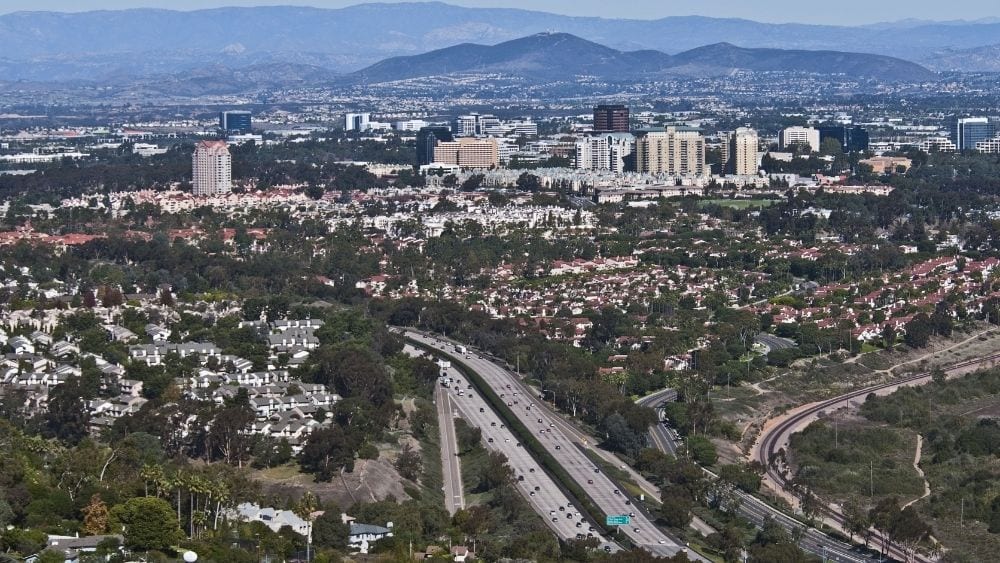

San Diego County

On the southwestern side of the state, you might be interested in purchasing a home in the County of San Diego. First-time buyers located anywhere in the County or in the city of Carlsbad, Coronado, Del Mar, Encinitas, Imperial Beach, La Mesa, Lemon Grove, Poway, San Marcos, Santee, Solana Beach or Vista may be eligible for the County of San Diego’s Down Payment and Closing Cost Assistance (DCCA) Program.

This opportunity allows low-income, first-time homebuyers to potentially qualify for a low-interest, deferred payment loan of up to 17% of the purchase price for down payment assistance and 4%, up to $10,000 in closing costs assistance. Other restrictions may apply, so be sure to visit the official website for details.

Additionally, the City of San Diego offers more options enabling residents to purchase their first home through deferred-payment loan programs, homeownership grants, and closing cost assistance. If you are looking to settle down in this beautiful and electric city, be sure to read up on available opportunities to receive financial assistance on the San Diego Housing Commission website.

San Mateo County

Residents of San Mateo County may wish to look into The Housing Endowment And Regional Trust (HEART) First Time Buyer Program. This unique loan program helps moderate-income homebuyers purchase their first home with 5% down payment – and no private mortgage insurance. This offer is subject to limitations and is only available for first-time homebuyers or those looking to move closer to transit in San Mateo County.

San Pablo

The City of San Pablo offers new homebuyer assistance through two programs. The first, WISH: San Pablo Economic Development Corporation First-Time Homebuyer Loans, offers grants to low-income households to assist with bridging the gap between a buyer’s affordable price and the purchase price to help with closing costs and down payment. The second is a Mortgage Credit Certification Program for First-Time Homebuyers to provide a federal income tax credit to lower monthly mortgage payments. More information on both programs can be found on the San Pablo CA website.

Santa Clara County

If you are considering a new home purchase in Santa Clara County, be sure to invest some time in researching Empower Homebuyers SCC for down payment assistance. This program is specifically for first-time buyers primarily residing in Santa Clara County. Other restrictions such as purchase price maximums and credit requirements may apply, so check out their website for details.

Additionally, if you are a first-time homebuyer in Santa Clara County or the cities of Menlo Park or East Palo Alto, you may be eligible for Santa Clara’s Homebuyer Empowerment Program (HELP). HELP assists borrowers with incomes slightly higher than Empower Homebuyers SCC with down payment assistance. Eligible middle-income first-time homebuyers may qualify to borrow up to 10% of a home’s purchase price. More restrictions and eligibility requirements are located on the official website.

Shasta Lake

The City of Shasta Lake offers homebuying assistance to first-time buyers in the form of a deferred loan which is due when the property is sold, transferred, or at the end of the loan term. Some exceptions apply to the first-time homebuyer requirement. These exceptions and other requirements for the Shasta Lake Homebuyer Program are listed on the official website.

Sonora

The City of Sonora also offers homebuying assistance for first-time buyers to help low-income households looking to purchase within the city limits as part of the City of Sonora Homebuyer’s Assistance Loan Program. Income and credit criteria may impact eligibility. See website for further details.

Turlock

The City of Turlock offers the Turlock First Home Buyers Program (FTHB) to new residents. The First Time Home Buyers Program helps eligible applicants purchase a home with down payment assistance of up to $50,000 or 40% (whichever is less) of the purchase price. More information on eligibility criteria is available online.

Purchase Your Dream California Residence

Buying your new home may seem stressful at first, but hopefully these options will give you more opportunities to seek out the perfect home for your budget. You may find that one of these assistance programs can help you just fill the financial gap and bring your dream house within reach. So…what are you waiting for? Start mapping your plans today and you’ll be in your new home before you know it!

The links on this site were researched by NewHomeSource. This is as cohesive a list as possible. Individual homebuyers should contact entities to fully understand requirements and processes.

Other California Resources

Melanie Theriault is a writer, counselor, and lifelong learner. She holds a B.A. in Sociology from Southwestern University, where she discovered her passion for fostering human connection through storytelling.

The Best Low Maintenance Plants for Any Home

The Best Low Maintenance Plants for Any Home